Wealth Management Platform Market Demand Rises with Growing HNWI Population 2030

Wealth Management Platform Market: Global Outlook, Trends & Future Opportunities (2024–2030)

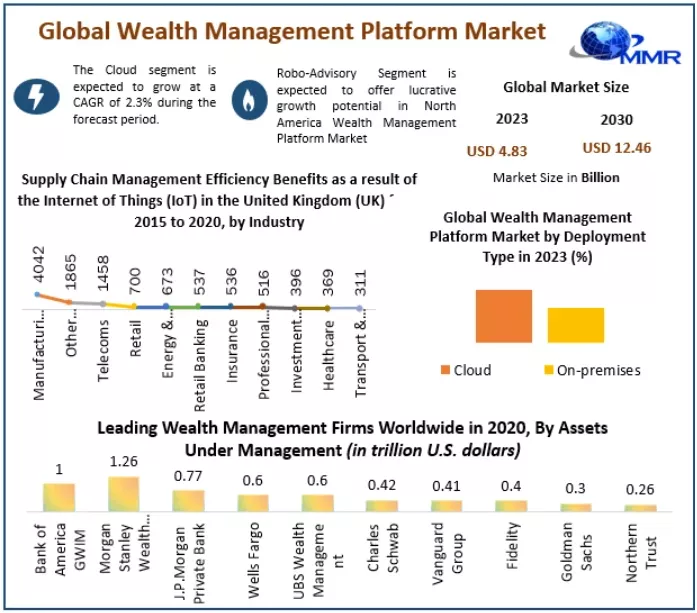

The Wealth Management Platform Market, valued at USD 2.1 billion in 2023, is undergoing a transformative shift driven by rapid digital adoption, rising global wealth, and growing demand for sophisticated financial advisory tools. The market is projected to expand at a remarkable CAGR of 37% from 2024 to 2030, ultimately reaching USD 19.02 billion by 2030.

Wealth management platforms have become indispensable for modern financial institutions, enabling seamless portfolio management, smarter investment decisions, and a more personalized advisory experience. These platforms combine AI, machine learning, data analytics, and automation, forming the digital backbone of next-generation wealth advisory ecosystems.

Market Overview

Wealth management platforms integrate a wide range of functionalities including:

Portfolio accounting & optimization

Real-time performance tracking

Risk assessment & stress testing

Regulatory compliance automation

Robo-advisory capabilities

Client onboarding, reporting, and communication tools

In a financial era marked by increasing investor sophistication and transparency demands, these platforms help advisors deliver tailored financial strategies while improving operational performance.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/63945/

Market Drivers

Personalization & Rise of Digital Advisory

Modern investors expect highly personalized financial advice. Platforms such as Wealthfront, Betterment, and Addepar utilize algorithms and analytics to offer customized portfolios and predictive insights, driving widespread adoption.

AI & Machine Learning Transforming Advisory Processes

AI-driven engines assist advisors in analyzing vast datasets, identifying market patterns, optimizing asset allocations, and forecasting returns. This enables:

Precision-based recommendations

Real-time market insights

Improved portfolio performance

Growth of Robo-Advisors & Hybrid Advisory Models

Low-cost automated advisory services from Schwab Intelligent Portfolios, Vanguard Personal Advisor, and others are attracting cost-sensitive investors, significantly boosting platform usage.

Increasing Regulatory Burden

Regulations such as GDPR, MiFID II, and FINRA rules require accurate documentation, reporting, and compliance monitoring. Wealth management platforms offer automated solutions that help institutions avoid penalties and reduce manual compliance workloads.

Expanding Global HNWI & Ultra-HNWI Base

The number of high-net-worth individuals is rising across North America, Europe, and Asia-Pacific. These clients demand holistic wealth strategies, multi-asset portfolios, and advanced digital access—expediting platform adoption.

Growing Demand for ESG Investment Tools

Sustainable investing is reshaping the financial landscape. Platforms such as MSCI ESG Manager and Morningstar Sustainable Investing are integrating ESG analytics, screening tools, and ratings to support values-based investing.

Cloud-Based Scaling & Digital Transformation

Cloud deployment has revolutionized accessibility, scalability, and security. Financial firms prefer cloud platforms due to:

Lower upfront costs

Faster deployment

Automatic updates

Seamless integration

Market Challenges

Data Security & Cyber Threats

Platforms dealing with sensitive wealth data are prime targets for cyberattacks. Breaches like those faced by Equifax raise concerns around trust and data privacy.

Legacy System Overhaul

Traditional banks often struggle to integrate modern digital platforms with outdated infrastructure, slowing transformation.

Market Fragmentation & Fintech Competition

Fintech disruptors such as Robinhood, Wealthsimple, and other agile platforms present intense competition, especially in the millennial and mass-affluent segments.

Regulatory Complexity

Constant regulatory changes across different regions increase operational burdens for financial institutions.

Market Segmentation

By Deployment

Cloud (Largest Share) – preferred for scalability, real-time access, and cost efficiency.

On-Premises – chosen by banks and large institutions with strict internal data control requirements.

By Advisory Model

Human Advisory

Robo-Advisory

Hybrid Advisory (fastest-growing)

By Application

Performance Management

Risk & Compliance Management

Financial Advice Management

Portfolio Accounting & Trading

Reporting

Others

By End Users

Investment Management Firms

Trading & Exchange Firms

Banks & Brokerage Firms

Family Offices & Other Financial Entities

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/63945/

Regional Insights

North America – Market Leader (55% Share in 2023)

North America remains the largest market, driven by:

High concentration of HNWIs

Established financial advisory ecosystem

Presence of industry giants (Charles Schwab, Fidelity, BlackRock, Morgan Stanley)

Predictive analytics, hybrid advisory, and robo-advisory adoption are especially strong in the U.S.

Europe – Rapid Growth Potential

Growth is driven by:

Increased regulatory scrutiny (MiFID II)

Rising ESG investment adoption

Wealth expansion in the UK, Germany, France, and Switzerland

Asia-Pacific – Fastest-Growing Region

Key markets: China, India, Japan, South Korea, Australia

Growth factors:

Rising middle class & HNWI population

Fintech ecosystem expansion

Digital banking surge

Middle East & Africa

Wealth creation from oil, real estate, and investment diversification drives platform adoption.

South America

Brazil leads adoption with increasing digital banking transformation.

Key Market Leaders (North America Focus)

Charles Schwab

Fidelity Investments

Vanguard Group

BlackRock, Inc.

Morgan Stanley

Merrill Lynch

Goldman Sachs

JP Morgan Chase & Co.

Wells Fargo

TD Ameritrade

LPL Financial

SEI Investments

Northern Trust

Stifel Financial

BNY Mellon Wealth Management

These companies dominate through integrated platforms, advanced analytics, and expansive client networks.

Future Outlook

The Wealth Management Platform Market is poised for exponential growth due to:

Increasing investor demand for transparency

AI-driven advisory and portfolio optimization

Expansion of hybrid advisory models

Greater focus on financial wellness and long-term planning

Rising ESG integration

Rapid digital transformation across global financial institutions

By 2030, wealth management platforms will move toward:

Fully automated workflows

Real-time decision intelligence

Holistic financial wellness ecosystems

Borderless global portfolio management

Hyper-personalized experience for each investor