Cloud Kitchen Market Size, Share, and Global Expansion Analysis 2030

Global Cloud Kitchen Market – A Comprehensive and Unique Analysis

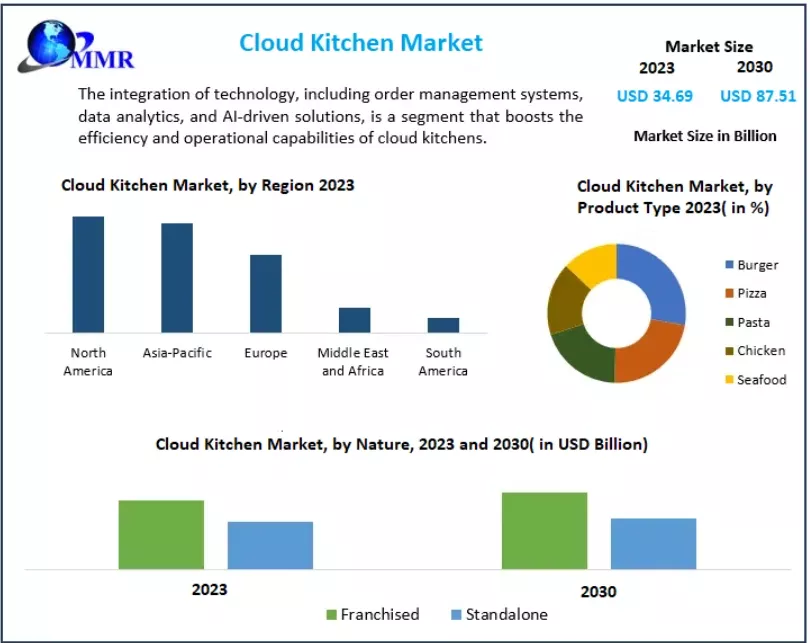

The Global Cloud Kitchen Market, valued at USD 34.69 billion in 2023, is projected to reach USD 87.51 billion by 2030, growing at a CAGR of 14.13%. The market's rapid expansion is driven by changing consumer preferences, digital adoption, rising food delivery platforms, and the growing need for cost-effective restaurant models.

Cloud Kitchen Market Overview

A cloud kitchen, also known as a ghost kitchen, dark kitchen, or virtual kitchen, is a delivery-only food production facility. It removes the need for dine-in space and allows operators to cater exclusively to online food orders through apps and third-party delivery aggregators.

The rise of cloud kitchens is closely tied to the global shift toward convenient food delivery, urban lifestyles, and the digitalization of the food ecosystem. The model significantly reduces operational costs since there is no requirement for store design, customer service areas, or high-rent prime locations. As a result, this setup has become popular among both independent food entrepreneurs and established restaurant chains.

With digital platforms reshaping food consumption trends, cloud kitchens have emerged as the future of scalable, data-driven food service operations.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/109430/

Cloud Kitchen Market Dynamics

Rising Demand for Food Delivery Services

The surge in meal delivery services is the biggest driver of cloud kitchen growth. Urban consumers prefer fast, convenient, and hassle-free meal options. Rising smartphone penetration, digital payments, and efficient logistics networks have strengthened online food delivery ecosystems.

For example:

In India, food delivery leaders like Zomato and Swiggy aim to serve 200 million users within the next five years.

Globally, platforms like DoorDash, Uber Eats, and Deliveroo continue to increase daily order volumes.

This rising demand directly boosts cloud kitchen adoption, as delivery-first brands rely heavily on their flexible and scalable structure.

Acceleration of Digital Transformation

Digital technology is at the core of cloud kitchen operations. AI-driven forecasting, automated kitchen management tools, and real-time analytics help operators refine menus, optimize resource usage, and tailor offerings to changing customer tastes.

Key digital enablers include:

AI-based demand prediction

Inventory automation

POS integration

Data-driven menu engineering

Mobile-first ordering experiences

Cloud kitchens require significantly lower capital investments compared to dine-in restaurants, making them attractive for new-age food entrepreneurs and established brands looking to expand quickly.

Opportunities for Scalable and High-Margin Operations

Cloud kitchens offer a lucrative business model with:

High scalability

Lower operating costs

Ability to experiment with multiple virtual brands

Faster market entry

Ghost kitchens provide the perfect environment for testing new menu ideas or running multiple niche cuisine brands under one roof. Cloud kitchens also allow restaurants to expand into new locations without high upfront costs.

Profit margins for successful cloud kitchen operations can reach 20–25%, significantly higher than typical dine-in establishments.

Restraining Factors – High Competition & Initial Setup Costs

Despite the advantages, the cloud kitchen industry faces challenges:

Potent competition among virtual brands

Need for strong digital branding

High operational expenses for commercial-grade kitchen equipment

Thin margins in highly competitive markets

Increased concerns about food quality, hygiene, and transparency

Customer loyalty is harder to build in a delivery-only ecosystem, giving rise to the need for advanced quality control, marketing investment, and reliable delivery partners.

Cloud Kitchen Market Segment Analysis

By Type

Independent Cloud Kitchens – Expected to grow fastest due to lower costs and cuisine flexibility.

Commissary/Shared Kitchens – Growing due to rising demand from food startups.

Kitchen Pods – Emerging trend for mobility-focused operations.

Independent cloud kitchens dominate due to their popularity among small businesses and growing preference for diverse cuisine experimentation.

By Product

Burger/Sandwich was the leading segment in 2023, driven by its universal popularity and suitability for delivery. Rapid growth is also observed in:

Pizza

Mexican/Asian food

Chicken-based meals

Health-focused menus (salads, low-calorie bowls, smoothies)

Rising health consciousness is driving the emergence of "wellness-first" cloud kitchen brands.

By Nature

Franchised Cloud Kitchens – Growing rapidly due to lower startup risks, centralized support, and brand recognition.

Standalone Kitchens – Suitable for niche concepts and hyperlocal brands.

Franchise models attract investors looking for stability and minimal operational complexity.

By Deployment

Web-based ordering systems remain important for established brands.

Mobile apps dominate, as smartphone usage drives 70–90% of online food purchases in major markets.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/109430/

Regional Insights

North America

A mature market, led by the US, where strong digital adoption and large-scale delivery platforms (DoorDash, Uber Eats) fuel growth. Virtual brands and multi-kitchen chains are expanding rapidly.

Europe

The region’s cultural diversity creates opportunities for cuisine-specific cloud kitchens. Urbanization and sustainability initiatives support digital food ecosystems.

Asia-Pacific

The fastest-growing region due to:

Dense urban populations

Rising disposable incomes

Mobile-first ordering habits

Massive growth in delivery platforms (Zomato, GrabFood, Foodpanda)

APAC markets like India, China, and Indonesia dominate new cloud kitchen openings.

Middle East & Africa

High income levels in GCC nations and rising tourism boost cloud kitchen adoption, supported by global delivery apps.

South America

Brazil and Argentina lead regional growth as cloud kitchens rise in popularity due to competitive pricing and growing delivery penetration.

Competitive Landscape

The market is highly competitive with global and regional players adopting aggressive expansion strategies. Key players include:

Auntie Anne’s

Domino’s Pizza

McDonald’s

Rebel Foods

Kitchen United

DoorDash Kitchen

Zuul Kitchen

Keatz

Kitopi

Starbucks

Ghost Kitchen Orlando

Dahmakan

… and more.

Innovative partnerships and cloud-first strategies are reshaping the competitive dynamics. For instance, Starbucks partnered with Alibaba's Ele.me in China to accelerate delivery-based growth.

Conclusion

The Global Cloud Kitchen Market is entering a high-growth phase fueled by digital adoption, shifting consumer preferences, and the increasing appeal of delivery-first dining. As technology evolves and cities become more connected, cloud kitchens are likely to become a dominant format in the global food service sector.

Their ability to scale quickly, test new concepts, and operate efficiently positions them as a long-term disruptor in the restaurant industry.