Core Banking Software Market Customer Experience and CRM Integration Forecast 2030

Global Core Banking Software Market Poised for Rapid Growth, Projected to Reach USD 21.02 Billion by 2030

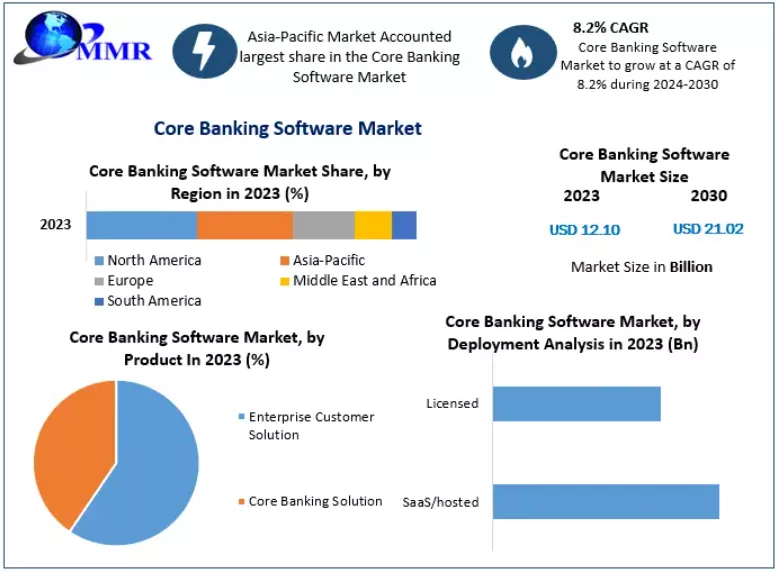

The global Core Banking Software (CBS) Market was valued at USD 12.10 billion in 2023 and is expected to grow at a CAGR of 8.2% from 2024 to 2030, driven by the rising adoption of digital banking technologies and cloud-based solutions. Core banking software enables banks to manage transactions, accounts, and client relationships across multiple branches on a centralized platform, facilitating seamless customer experiences and operational efficiency.

Market Overview

Core banking solutions streamline backend banking operations while integrating automated frontend processes, allowing clients to access services across branches nationwide. The increasing integration of Artificial Intelligence (AI) in CBS helps banks extract actionable insights, enhance decision-making, detect fraudulent activities, and anticipate customer needs, fueling market expansion.

Key Market Drivers

Digital Transformation in Banking: A growing preference for digital banking experiences among millennials and other customer segments is driving demand for advanced core banking platforms.

Cloud-Based Deployment: Cloud CBS platforms provide scalability, real-time transaction tracking, and reduced operational costs, leading to increased adoption across global banks.

Big Data and Cybersecurity Integration: The inclusion of advanced analytics and cybersecurity in CBS helps banks manage risks, process complex data, and deliver personalized financial services.

Flat 30% Discount | Free Sample Available@https://www.maximizemarketresearch.com/request-sample/148072/

Market Restraints

Despite the growth, market expansion may be constrained by limited awareness of core banking solutions among smaller banks and financial institutions. Additionally, concerns around data privacy, cybersecurity vulnerabilities, and mobile malware pose challenges for widespread adoption.

Market Segmentation

By Solution Type:

Enterprise Customer Solution: Dominating the market with over 47% share in 2023, this segment integrates CRM and ERP systems, allowing banks to manage client data, improve cross-selling, and optimize regulatory reporting.

Core Banking Solution: Facilitates inter-branch operations, loan and deposit management, and end-to-end transaction processing, enhancing operational efficiency and customer satisfaction.

By Deployment Analysis:

SaaS/Hosted: Leading the market due to rising demand for cloud-based banking systems, offering enhanced flexibility, lower upfront costs, and real-time transaction processing.

Licensed: Expected to witness steady growth as banks adopt licensed solutions to address security concerns and reduce operational costs.

Regional Insights

North America: Dominated the market with 29% share in 2023, supported by early adoption of cloud-based CBS by leading banks and SMEs.

Asia-Pacific: Projected to grow at a CAGR of 4.7%, driven by mobile and online banking adoption in developing economies like China and India.

Europe, Middle East & Africa, South America: The market in these regions is expanding steadily, supported by digital transformation initiatives and increasing demand for efficient banking solutions.

Get 30% OFF | Request Free Sample@https://www.maximizemarketresearch.com/request-sample/148072/

Key Market Players

Capgemini

Finastra

FIS

Fiserv, Inc.

L Technologies Limited

Infosys Limited

Jack Henry & Associates, Inc.

Oracle Corporation

Temenos Group

Unisys SAP SE

TATA Consultancy Services

Capital Banking Solutions

EdgeVerve System Limited

Fidelity National Information Services

Mambu GmbH

Backbase

Forbis

Securepaymentz

nCino

Bricknode

Wipro Core Banking Service

C-Edge Technologies

Market Trends

Accelerated adoption of cloud and AI-enabled CBS solutions.

Rising interest in digital-first banking experiences.

Increasing use of big data analytics for risk management and personalized financial services.

Key Questions Answered in the Report:

What are the growth drivers and challenges in the Core Banking Software market?

Which solutions and deployment models dominate the market?

How do regional markets differ in adoption rates and growth potential?

Who are the leading players, and what strategies are they implementing?

What are the latest trends and innovations shaping the market?

Conclusion

The global Core Banking Software Market is set for robust growth, with technological advancements in AI, cloud, and cybersecurity reshaping banking operations. As financial institutions increasingly adopt CBS solutions, the market is poised to reach USD 21.02 billion by 2030, enabling efficient, secure, and customer-centric banking services worldwide.